how to determine tax bracket per paycheck

Essentially your total tax bill will be 9875. However your marginal federal tax rate is 205 percentthats the tax rate you pay on anything you earn beyond your current earnings.

Gross Pay Vs Net Pay What S The Difference Aps Payroll

Using the brackets above you can calculate the tax for a single person with a taxable income of 41049.

. The table below shows the tax brackets for the federal. The irs income tax withholding tables and tax calculator for the current year. The first 9950 is taxed at 10 995.

An individual who made over 216000 as a single filer in 2022 has to pay 35. Third bracket taxation 40 126- 50 000 income limit A tax rate of 22 gives us 50 000 minus 40 126 9 874. How It Works.

Your bracket depends on your taxable income and filing status. The state tax year is also 12 months but it differs from state to state. There are seven federal tax brackets for the 2021 tax year.

For 2020 look at line 10 of your Form 1040 to find your taxable income. Your taxable income is the amount used to determine which tax brackets you fall into. Therefore 22 X 9 874 2 17228.

But your marginal tax rate or tax bracket is. The easiest way to calculate your tax bracket in retirement is to look at last years tax return. Use this tool to.

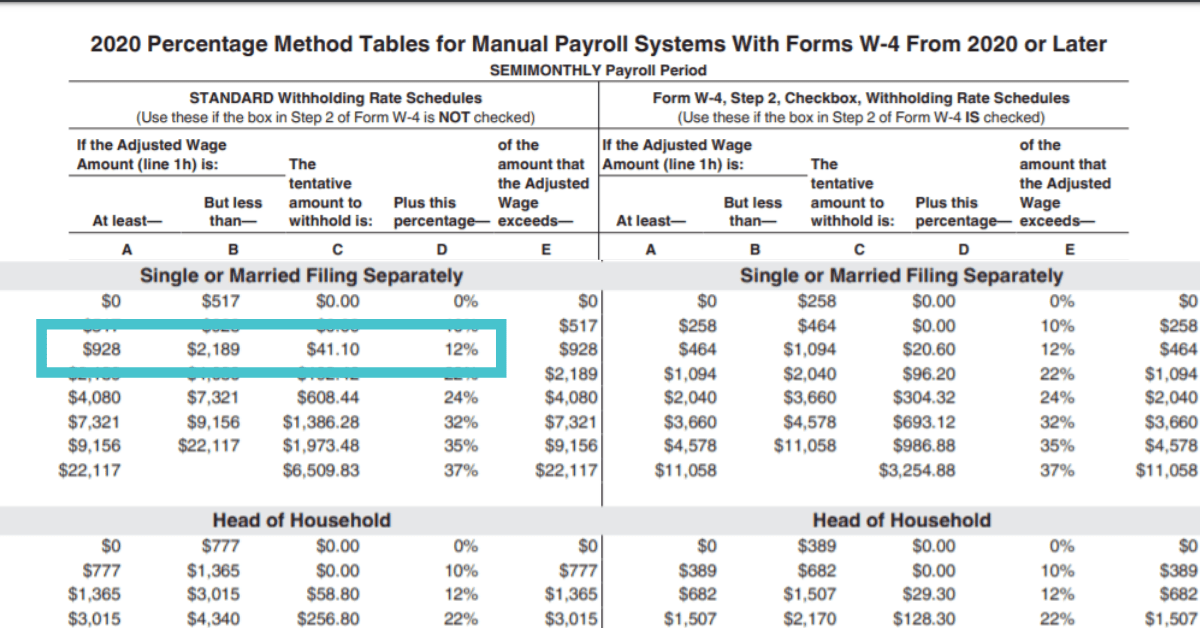

Now use the 2022 income tax withholding tables to find which bracket 2025 falls under for a single worker who is paid biweekly. See how your refund take-home pay or tax due are affected by withholding amount. You find that this amount of 2020 falls in the at least 2000 but less than 2025 range.

These ranges are referred to as brackets. 2021 Federal income tax brackets 2021 Federal income tax rates. Using the 2021 standard deduction would put your total estimated taxable income at 35250 60350 - 25100 placing you in the 12 tax bracket for your top dollars.

You find that this amount of 2025 falls in the. Each IRS tax bracket has a slightly different tax rate. For example if you earned 100000 and claim 15000 in deductions then your taxable.

Estimate your federal income tax withholding. 10 12 22 24 32 35 and 37. Income falling within a specific bracket is taxed at the rate for that bracket.

As you move up the brackets the percentage of tax increases. 250 minus 200 50. The next 30575 is taxed.

This parallel tax income system requires high-income taxpayers to calculate their tax bill twice. 2021-2022 federal income tax brackets rates for taxes due April 15 2022. The total tax bill for.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

New Tax Law Take Home Pay Calculator For 75 000 Salary

What Is My Tax Bracket Turbotax Tax Tips Videos

Decoding Your Paystub In 2022 Entertainment Partners

Tax Planning For Beginners 6 Tax Strategies Concepts Nerdwallet

Paycheck Tax Withholding Calculator For W 4 Tax Planning

Free Online Paycheck Calculator Calculate Take Home Pay 2022

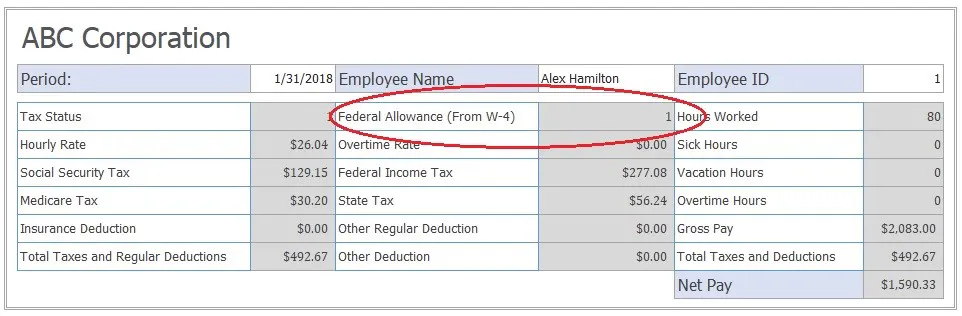

How To Calculate Payroll And Income Tax Deductions Peo Human Resources Blog

How To Fill Out Form W 4 In 2022 Adjusting Your Paycheck Tax Withholding

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Understanding Your Paycheck Credit Com

Is There A Wage Minimum Limit Before Federal Tax Is Withheld My W 2 Shows No Federal Tax Withheld On My Line 1 Wages Of 4657 89

Tax Brackets How To Figure Out Your Tax Bracket

How To Fill Out Form W 4 In 2022 Adjusting Your Paycheck Tax Withholding

How To Calculate Federal Income Tax

How Do I Read My Pay Stub Gusto

Tax Reform And Your Paystub Things To Know Credit Karma

Paycheck Calculator For 100 000 Salary What Is My Take Home Pay

:max_bytes(150000):strip_icc()/what-is-included-on-a-pay-stub-2062766-FINAL-edit-f9458e043f2e4c5ab87a4ef5cec0cd5d.jpg)